The risks facing European real estate in the coming months

Demand for new homes is affected by rising interest rates and inflation. And margins squeezed by construction costs, predicts S&P.

Property developers and builders must prepare for difficult times across Europe. According to S&P, a number of external factors are likely to affect the new construction sector over the next 12 to 18 months. Rising interest rates, inflation and energy costs due to the Russian-Ukrainian conflict could have consequences for the European real estate sector.

Interest rates and inflation, how they affect the real estate market

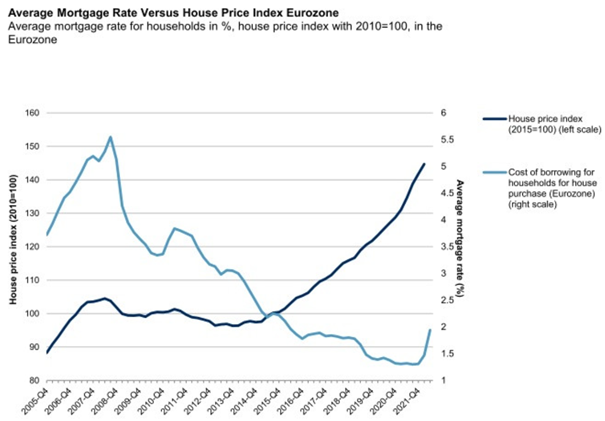

According to S&P, the current conditions could lower the volume of sales. The market is heavily dependent on mortgages (70% of housing built is paid for with mortgages in Europe), which are influenced by interest rates and banking conditions.

Uncertainty can lead families to postpone the purchase of a new home, because the rise in property prices, linked to inflation, as well as the cost of living, is not accompanied by a increase in real wages. Portugal, for example, has the largest gap between house prices and wages in the OECD, with the cost of housing exceeding labor income by 47.1% in the first quarter of 2022.

In addition, the conflict between Russia and Ukraine, as well as global supply chain issues, are driving up costs and shortages for builders, potentially delaying and making projects more expensive.

Housing prices in Europe

To maintain profit margins, S&P says cost optimization plans and strong cash reserves are needed. In addition, among the factors underlying the prices, there is a problem of new housing stock. In Portugal, for example, the demand for real estate assets in the face of supply has caused house prices to explode, generally in the country, in recent years.

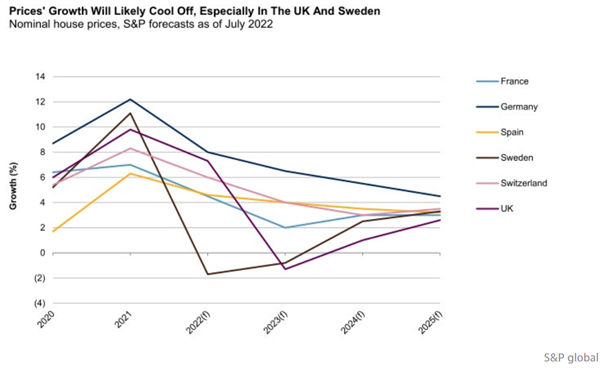

Prognosis on European real estate

Here are the main trends identified by S&P for the coming months in the new construction sector:

Rising interest rates and weakening purchasing power are expected to reduce demand for new homes in Europe, a market that relies heavily on mortgages, although government incentives can serve as a stimulus.

In addition, rising construction costs, energy costs (which account for 5-10% of price increases), labor shortages, land scarcity, and supply chain issues continue to hamper the delivery of housing units.

Tighter environmental and safety requirements are driving demand for new construction, but also creating additional costs and technical challenges for builders.

It is therefore expected that in the last quarter of the year, European property developers and builders will already start to come under increasing pressure on revenues and margins, as it will be difficult to pass on rising costs to end customers. .

The bulk of the impact is not expected to be felt until 2023. However, most S&P-rated European property developers are expected to overcome headwinds and maintain credit metrics in line with annual ratings, thanks to strong balance sheets and good levels of liquidity.