IMPORTANCE OF THE CHOICE OF LEGAL STRUCTURE

In the context of a succession, the sale of a business, the tax consequences can hold unpleasant surprises.

A skilful structuring makes it possible to carry out a succession, sale of company exempt from taxes or at least optimized on the tax plan.

The choice of the legal structure of a company is not often taken into account from the start of the activity. It is not uncommon to find that it is at the time of the sale of the latter that people begin to be concerned and it is unfortunately often too late to act and make the changes necessary for an advantageous final taxation,

Consequently, a large number of owners of small SMEs for whom this sale often represents the capital used to finance their retirement realize that once the taxes and duties have been paid, the balance will not be enough to achieve their goal.

If the legal structure of the seller is a sole proprietorship or a general partnership, the capital gain from a sale of the company (ie the difference between the price paid by the buyer and the book value of the company) will be subject to the income tax and social insurance in addition to other income in the year of the sale, which is equivalent, depending on the private taxation of the person concerned, to charges of up to 50% of the sale profit.

- Taxation when selling a business in Switzerland?

The tax rate on the sale of a business can vary between 0% and 50% depending on the structure of the transaction.

The elements that determine this rate are:

- The legal structure of the Seller (ie SA, Sarl or partnership)

- Buyer's legal structure

The taxation of a business transfer will be different if the structure of the seller and/or buyer is a partnership (ie sole proprietorship or general partnership or a capital company (ie SA or Sarl

2 - Potential taxes when selling a business?

1. Taxes on the capital gain on the sale of a company (ie for partnerships)

2. Indirect partial liquidation (ie for SAs, Sarl)

3. Transposition (ie for SAs, Sarl)

These taxes can be avoided with the right legal structures and tax and financial preparation upstream of a business transfer transaction.

3 - Minimize taxation when selling a business?

It is essential and essential to put in place the right legal structures from the start!

A financial preparation upstream can allow you to avoid paying any tax!

- Prepare the legal and financial structure ahead of the sale to minimize taxation when selling a business.

- Negotiate the legal structure that the buyer will use to buy you out, as this may trigger other taxes (eg indirect partial liquidation)

The Swiss tax authorities may require 5 years before recognizing your new structure if necessary!

4 - How to avoid capital gains tax?

The capital gain from the sale of a company or the capital gain from the sale of shares in a holding company will not be taxed in the same way depending on the legal structures of the parties to the transaction. A corporation (ie SA, Sarl) will be exempt from capital gain while a partnership will be subject to this tax. It is therefore important to transform your business into a capital company in the event of the sale of a business with a significant capital gain.

5 -Taxes applied in the different scenarios

- Sole proprietorship or partnership sale

collective

If the legal structure of the seller is a sole proprietorship or a general partnership, the capital gain on a sale of a company (ie the difference between the price paid by the buyer and the book value of the company) will be submitted and assimilated like an income tax. It will also be necessary to add the social charges (10%) which will also have to be paid.

Sole proprietorship and general partnership are therefore inadequate structures for minimizing the tax on the sale of business shares. One of the solutions to this situation is to transform the partnership into a capital company (ie SA or Sarl). This must be done 5 years before the actual sale of the company for the tax authorities to recognize this new structure. Selling your company with the lowest possible taxation must therefore be done with another legal structure.

CONCLUSION – PARTNERSHIPS ARE AN INADEQUATE FORMAT AT THE TAX LEVEL FOR THE TRANSMISSION OF BUSINESSES IN SWITZERLAND

- Capital company – SA or Sarl

A capital company (ie SA or Sarl) benefits from an exemption from capital gains tax in Switzerland.

This means that no tax has to be paid on the capital gain of the shares/shares of the company when the SME is sold.

However, there is a situation where taxes must still be paid on the capital gain. If the seller holds the company privately and the buyer is a legal person (ie a company), this may lead to "indirect partial liquidation" which may generate tax payments after the sale (ie as described below). below).

B1. The buyer is a natural person

If the company being sold is a capital company held by a natural person in a private capacity and the buyer is also a natural person, no tax will have to be paid on the capital gain from the sale of the company. Taxation on the sale of a business is therefore not an issue in this case.

B2. The buyer is a legal person (ie company)

If the company for sale is a capital company owned by a natural person and the buyer is a legal person, two elements may apply: the "Transposition" and the "Indirect Partial Liquidation"

.

"Indirect partial liquidation" stipulates that taxes may be required from the seller after the sale of the company in the event of the presence and distribution within 5 years of excess reserves (eg large cash reserve in the company) in the company sold.

In this situation, capital gains are considered taxable income (and no longer exempt).

In order to avoid being in this business sale tax situation, transaction structures can be put in place by merger and acquisition advisors.

B2.1. What are the conditions for being in an indirect partial liquidation situation?

- The sale involves a stake of at least 20%.

- The transfer of shares leads to their passage from the private fortune of the seller to the commercial fortune of the buyer.

- There are distributions of excess reserves (eg dividend greater than annual net income) within 5 years after the sale of the company

B2.2. Transposition, how does this impact the tax on the sale of a company?

Transposition is the act of transforming taxable (excess) reserves into non-taxable reserves.

As an example, imagine that a company has 100 of taxable excess cash and the new owner replaces this cash with a financial participation of another company. This transaction would allow the initially taxable amount (ie cash) to be replaced by a non-taxable amount (ie the new financial participation).

To compensate for this mechanism, the tax administration taxes this type of "transposition" as returns of fortunes. In order to avoid being in this tax situation, transaction structures can be set up by merger and acquisition consultants for SMEs.

C – Capital company – Real estate company SA or Sarl

A real estate company (SI) in Switzerland is a form of company, generally anonymous, whose corporate purpose is specifically the investment, construction and operation of buildings.

If the company for sale qualifies as a real estate company, the sale represents a transfer of economic ownership and lods and sales duties, as well as real estate gains taxes, are applicable.

6 – Donation subject to reservations

If shares are sold to a general partnership, to old or new members, the difference between the market value and the actual sale price (too low) may be considered a gift and gift tax may be levied accordingly.

Some cantons have a massive exemption from inheritance or gift tax in the context of business successions to tax-exempt recipients or heirs, such as e.g. the canton of Zurich which exempts at 80%.

However, depending on the canton, a period of between 5 and 15 years must be taken into account, during which the establishment must retain its corporate name or a majority stake must remain.

7 – Donations and legacies

In almost all cantons, gifts and inheritances to direct descendants are exempt from gift and inheritance tax.

If a succession within the family (in particular to children or grandchildren) is planned, the sole proprietorship, the participation in the partnership or the participations in capital companies can be given or bequeathed without taxation. The donor or the deceased does not suffer any tax consequences in this case either.

In principle, this exemption also applies to property taxes (lods duty and real estate sales and gains taxes), insofar as real estate is involved.

In the case of an internal succession within the family, the aspects of the law of succession (protection of the reserved part of the heirs who are not successors) must be taken into account. In some cases, a non-taxable division of the business into two (or more) parts of establishment is necessary for this purpose.

If the succession within the family should not be carried out free of charge, but facilitated by a reduced sale price, the company can be "lightened" in two ways: on the one hand, if this also turns out to be less attractive on a tax plan, by the withdrawal of cash useless for the operation of the company or, on the other hand, by the repurchase of own shares (up to 10%) at their market value, which must be resold within a period of 6 years.

For reminder and information

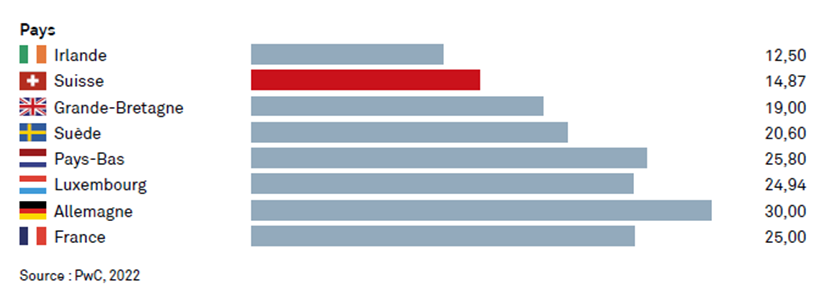

Corporate tax in Europe

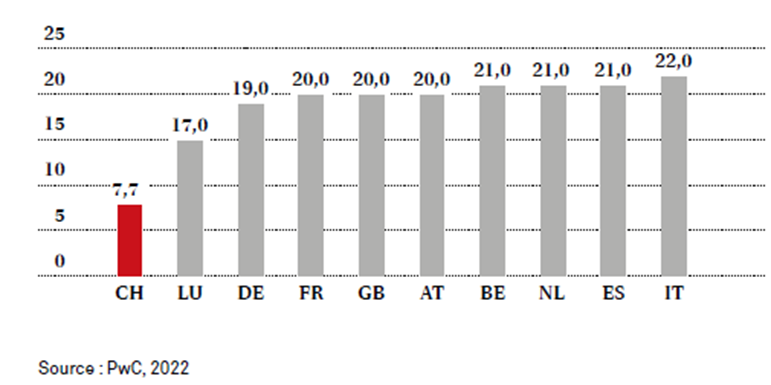

VAT in Europe

Tax shares in Europe

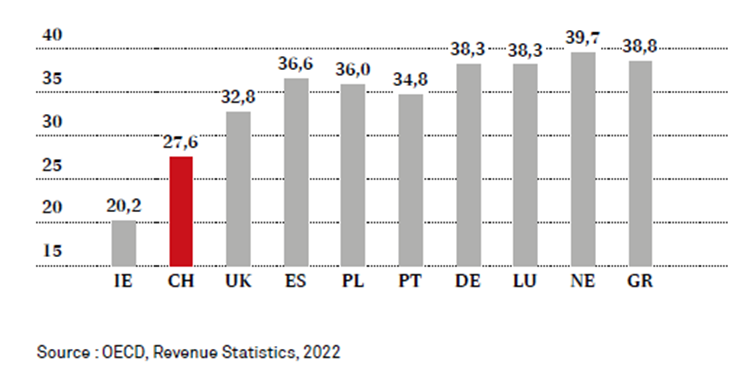

Taxes and contributions to social insurance 2020 in relation to GDP (in %)