Real estate market easing Swiss mortgage rates down

The decline in inflation leads to a drop in interest rates, particularly applied to construction.

Over the past four weeks, mortgage rates have fallen significantly in Switzerland. The twelve providers whose guide rates for fixed-rate mortgages are regularly collected by the magazine “Finanz und Wirtschaft” have all adjusted their credit rates downwards. And sometimes significantly. All durations are affected.

For ten-year maturities, indicative rates fell by an average of 0.38 percentage points. Zürcher Kantonalbank and Swiss Life lowered their rates by 0.46 percentage points for ten-year fixed-rate mortgages. Zurich insurance even reduced its indicative rate by 0.48 points for five-year mortgages. By way of comparison: on the market, the average decline is 0.32 points for a period of five years.

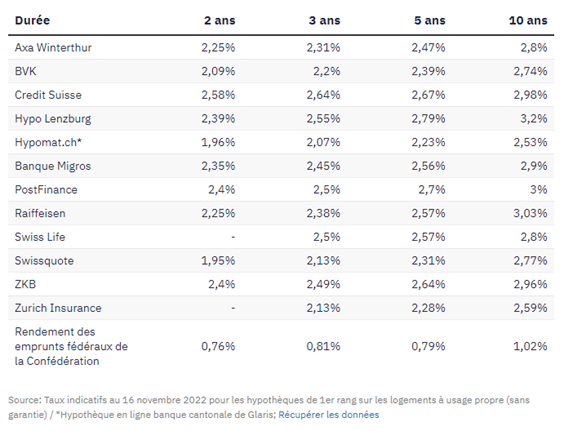

Fixed mortgage rates in %

Mortgage interest rates of 3% or more for ten-year contracts seem a thing of the past, for now at least.

Last month, all but one establishment still demanded rates of 3% or more. Now there are only three to do so: Hypo Lenzburg, Raiffeisen and PostFinance.

Rates below 2% are again possible for short maturities. Swissquote and the online platform Hypomat, behind which the Cantonal Bank of Glarus is located, offer them.

Inflationary pressure is easing

The general downward correction shows that the inflationary environment has eased. In Switzerland, annual consumer price inflation fell in October for the second consecutive time. It amounts to 3%. It thus remains well above the National Bank's price stability target of 2%.

Last week, National Bank President Thomas Jordan again stressed that the key interest rate should be raised again in December. But inflation is on the path predicted by the currency's guardians, who expect it to fall to 2% and lower next year. The pressure to set the key rate much higher is therefore diminishing.

It remains to be seen whether the large decline in mortgage rates recorded today really constitutes a trend reversal. After July's correction, this is only the second downward monthly correction this year. Overall, ten-year mortgages are still more than twice as expensive as they were at the start of the year.

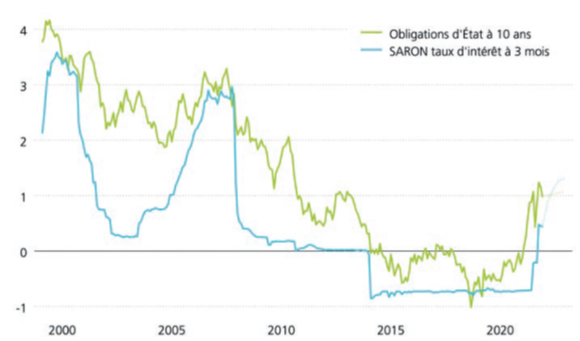

SARON yields at 3 months and actuarial yields at 10 years and in percentage

Market expectations regarding the evolution of interest rates are reflected in the futures markets.

Short-term interest rates measured in 3-month SARON terms in Switzerland are forecast to increase by 0.75 percentage point over the next twelve months .

If this assumption is confirmed, the cost of Saron mortgages will also increase by 0.75 percentage points. Nevertheless, it is the long-term fixed mortgages that have experienced the strongest rise in rates, since they are in line with the development of long-term rates on the capital market.

Global economic data

Source: Bloomberg – Finanz und Wirtschaft.