The revision of inheritance law will come into force on January 1, 2023

CHANGES ON 01.01.2023

https:/lwww.admin.ch/gov/fr/accueil/documentation/communiques.msg-id-83570.html

During its meeting of May 19, 2021, the Federal Council decided that the revision of the inheritance law would come into force on January 1, 2023. These new provisions will allow testators to freely dispose of a greater part of their assets.

The new inheritance law will be more flexible . The testators will be able to freely dispose of a greater part of their property.

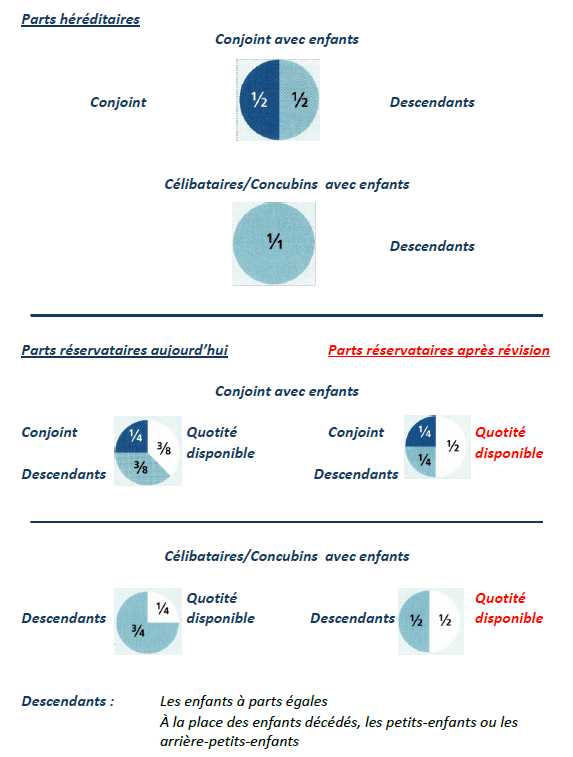

Currently, the hereditary reserve of children is equal to three quarters of the legal share. In the future, it will be reduced to half. The parents' reserve is purely and simply abolished.

That of the spouse or registered partner, on the other hand, remains unchanged . The person who wishes to settle his succession by means of a will will be less constrained by hereditary reserves. She will be able to dispose of her property more freely, and favor more, for example, her de facto partner. The Federal Council has decided that the revision of inheritance law will come into force on January 1, 2023.

The transfer of a business will also be facilitated

Definitions and explanations

In order to better understand this case, here are some explanations of the legal terms used in inheritance law.

Legal heirs

The legal heirs are those designated by law to the succession if the deceased has not expressed his last wishes..

The right to inheritance varies according to the marital status of the deceased at the time of death and the degree of relationship of their survivors.

Legal heirs inherit according to a certain order of succession based on the degree of relationship or, more precisely, according to the order of relatives in relation to the deceased.

The closest relatives exclude those who are more distant . Therefore, the legal heirs are always those of the closest relatives.

The first family is that of the direct descendants of the deceased, either his children or their descendants. Children inherit in equal shares per branch.

Adopted children or natural children inherit like legitimate children;

The second kinship inherits when there are no descendants remaining. It includes the father and mother or, in the case of predeath, the brothers and sisters of the deceased or even their descendants if one of them is predeceased;

The third family is that of the grandparents of the deceased and their descendants. These are uncles and aunts, cousins or their descendants .

The surviving spouse is outside the family since he or she is not related by blood.

Certain close relatives are necessarily entitled to a certain proportion of the estate. The reserved heirs are:

The surviving spouse

The descendants

inheritance share

The legal inheritance share is the share of the inheritance to which a person is entitled by law, unless the testator has decided otherwise (e.g. with a will).

Hereditary reserve

The hereditary reserve is the minimum share of inheritance, defined by law, to which a person is entitled; it is lower than the legal inheritance share. However, not all legal heirs are entitled to a hereditary reserve.

Only the spouse and children of the deceased are entitled to a compulsory share

If a will does not respect the hereditary reserve, it is not automatically void; it must first be contested by the legal heirs.

Available quantity

The available portion is the portion of the estate that remains, after deduction of the hereditary reserves. The testator can transmit this at his discretion, to individuals or non-profit organizations, by means of a will or an inheritance agreement.

Testament Switzerland

The Swiss civil code provides for three forms of will: holographic, public and oral. The holographic will is the simplest and most widespread form. It must be handwritten in its entirety, dated and signed by the testator.

Swiss inheritance agreement

A succession pact is a contract between two or more people whose object is the succession of at least one of them.

Any person capable of discernment and aged 18 or over can conclude an inheritance pact.

The settlor can, with the agreement of the heirs, freely dispose of his estate without limit. By this act, a reserved heir can renounce all or part of his estate, for example.

The succession agreement may harm the reserves of other heirs not participating in the contract.

In this case, the injured parties can assert their rights through an action against the other heirs (action for reduction).

The inheritance pact is drawn up in authentic form (with a notary).

Unlike the will, the inheritance pact cannot be modified unilaterally. Any change must be made in the presence of a notary and with the participation of all parties.

Changes for married couples

- The hereditary reserve of descendants will decrease.

- Today, children are entitled to a hereditary reserve of 3/8.

- From now on this share will amount to 1/4 The available portion will increase from 3/8 to 1/2.

- The testators will therefore be able to dispose of a larger share of the estate as they wish.

- Married couples living in a blended family will be able, thanks to the increase in the available quota, to benefit their own children, but also take their step-children into account.

- Spouses can better protect each other. This aspect is of particular importance when the surviving spouse is dependent on income from the estate or must amortize the mortgage to keep their home.

- Otherwise, he will at worst be forced to sell in order to reduce his fixed costs or to compensate the children.

- A reduction in the hereditary reserve allows business leaders to more easily regulate succession within their company.

Changes for cohabiting partners

- Inheritance law does not regulate cohabitation.

- Without specific provisions, cohabitants and their children will therefore not be able to claim inheritance even after the revision of inheritance law.

- These constellations can be very different, it is not the law but the testators who, including after the reform, will remain authorized to decide on the people they wish to favor.

- In the future, testators will have greater room for maneuver in doing so, because the hereditary reserve of descendants will decrease and that of parents will disappear entirely.

- Cohabitants and blended families must also take steps to avoid an unfair situation when sharing inheritance.

- Anyone who has already settled their estate and, for example, drawn up a will should study with an independent specialist the points that need to be adapted due to the reform in order to avoid making mistakes.

Loss of right to hereditary reserve during divorce proceedings

Divorced spouses whose divorce judgment is enforceable lose all rights to the other's estate; this also applies to registered partnerships.

The surviving spouse and registered partner currently their right to the inheritance share and the hereditary reserve if the other spouse or partner dies in the middle of the inheritance procedure. divorce.

Today, registered partners and married couples are on equal footing before the law. With the revision, the spouse and registered partner will lose their right to hereditary reserve upon filing divorce proceedings .

Until the divorce judgment is enforceable, the surviving spouse and registered partner will still be entitled to their legal share of the estate unless the testator decides otherwise (e.g. through a will).

Changes, transfer of a business

- Passing on the business within the family is much more than just a legal challenge.

- Just the act of favoring or harming one family member among many others can harm the good understanding between families and generate multiple problems for the new owner.

- In the new inheritance law, hereditary reserves constitute a less important part, which facilitates transmission within the family.

Outlook for future review stages for family businesses

- In the next stage of the revision of inheritance law, it is planned to facilitate the transfer of family businesses.

- Family businesses are particularly at risk in the event of the death of the owner if his estate is not settled.

- Depending on the valuation of a company, its buyers must pay high compensatory compensation to their co-heirs who are protected by hereditary reserves.

- This can put a company in difficulty or even lead to its fragmentation if a large part of the assets are tied up in the company.

- The revision aims, among other things, to make it possible to defer the payment of compensatory allowances if the company has insufficient liquidity for immediate payment.

Legal inheritance shares, hereditary reserves and available portion

SWISS CIVIL CODE – INHERITANCE LAW

RO 2021 312 OF December 18, 2020 – COMING INTO FORCE ON JANUARY 1, 2023

Schweizerische Bundeskanzlei / Kompetenzzentrum Amtliche Veröffentlichungen (KAV)

Swiss Civil Code

(Inheritance law)

Modification of December 18, 2020

The Federal Assembly of the Swiss Confederation,

having seen the message from the Federal Council of August 29, 2018[1],

stopped:

I

The civil code [2] is amended as follows:

Art. 120, par. 2 and 3

2 Divorced spouses cease to be legal heirs of each other.

3 Unless otherwise stipulated, spouses lose all benefits resulting from provisions due to death:

1. at the time of divorce;

2. at the time of death if divorce proceedings resulting in the loss of the surviving spouse's reserve are pending.

Art. 216, par. 2 and 3

2 Profit sharing allocated in excess of half is not taken into account for the calculation of the hereditary reserves of the surviving spouse or registered partner as well as the common children and their descendants.

3 Such an agreement cannot affect the reservation of non-common children and their descendants.

2 The same applies in the event of dissolution of the plan due to death, when divorce proceedings resulting in the loss of the surviving spouse's reserve are pending.

Art. 241, par. 4

4 Unless otherwise stipulated in the marriage contract, the modification of the legal division does not apply in the event of death when divorce proceedings resulting in the loss of the surviving spouse's reserve are pending.

Art. 470, par. 1

1 Anyone who leaves descendants, their spouse or registered partner has the right to dispose of what exceeds the amount of their reserve upon death.

Art. 471

| II. Reserve |

The reserve is half of the inheritance tax.

Art. 472

| III. Loss of reserve in the event of divorce proceedings |

1 The surviving spouse loses his or her reserve if at the time of death divorce proceedings are pending and:

1. the proceedings were initiated on a joint petition or continued in accordance with the provisions relating to divorce on a joint petition, or

2. the spouses have lived apart for at least two years.

2 In such a case, the reserves are calculated as if the deceased had not been married.

3 Paras. 1 and 2 apply by analogy to the procedure for dissolution of the registered partnership.

Art. 473

| IV. Usufruct |

1 Whatever use he makes of the available portion, the spouse or registered partner may, by disposition due to death, leave to the survivor the usufruct of the entire share devolved to their common descendants.

2 This usufruct takes the place of the inheritance right attributed by law to the surviving spouse or registered partner in conjunction with these descendants. In addition to this usufruct, the available portion is half of the estate.

3 If the surviving spouse remarries or enters into a registered partnership, his usufruct ceases to encumber for the future the part of the estate which, at the death of the testator, could not have been the subject of the usufruct legacy according to the ordinary rules on descendants' reserves. This provision applies by analogy when the surviving registered partner enters into a new registered partnership or marries.

Art. 476

| 3. Insurance in the event of death and linked individual protection |

1 Insurance in the event of death taken out on the head of the deceased, including within the framework of linked individual insurance, which he has taken out or which he has disposed of in favor of a third party by inter vivos act or due to death , or which he transferred free of charge to a third person during his lifetime, are only added to the estate for the redemption value calculated at the time of death.

2 The claims of beneficiaries resulting from the deceased's individual pension provision with a banking foundation are also added to the estate.

Art. 494, par. 3

3 Provisions due to death and inter vivos gifts which exceed customary gifts may, however, be challenged, to the extent:

1. where they are irreconcilable with the commitments resulting from the inheritance pact, in particular when they reduce the advantages resulting from the latter, and

2. where they have not been reserved in this pact.

Art. 522

| B. Reduction action I. Conditions 1. In general |

1 Heirs who receive in value an amount lower than their reserve have the action for reduction, until the reserve is reconstituted, against:

1. acquisitions due to death resulting from the law;

2. donations due to death, and

3. inter vivos gifts.

2 Provisions due to death relating to the lots of legal heirs are considered simple rules of sharing if they do not reveal a contrary intention on the part of their author.

Art. 523

| 2. Reservers |

Acquisitions due to death resulting from the law and donations due to death from which reserved heirs benefit are reducible in proportion to the amount of what exceeds their reserve.

Art. 529

| 4. Insurance in the event of death and linked individual protection |

1 Insurance in the event of death taken out on the head of the deceased, including within the framework of linked individual insurance, which he has taken out or which he has disposed of in favor of a third party by inter vivos act or due to death , or which he transferred free of charge to a third person during his lifetime, are subject to reduction for their redemption value.

2 The claims of beneficiaries resulting from the deceased's individual pension provision with a banking foundation are also subject to reduction.

Art. 532

| III. Order of reductions |

1 The reduction is carried out in the following order until the reserve is replenished:

1. on acquisitions due to death resulting from the law;

2. on donations due to death;

3. on inter vivos gifts.

2 Inter vivos gifts are reduced in the following order:

1. donations granted by marriage contract or property agreement which are taken into account for the calculation of reserves;

2. freely revocable donations and linked individual pension benefits, in the same proportion;

3. other donations, going back from the most recent to the oldest.

II

The modification of other acts is regulated in the appendix.

III

1 This law is subject to referendum.

2 The Federal Council sets the date of entry into force.

| Council of States, December 18, 2020 President: Alex Kuprecht Secretary: Martina Buol | National Council, December 18, 2020 The president: Andreas Aebi The secretary: Pierre-Hervé Freléchoz |

Expiration of the referendum deadline and entry into force

1 The referendum deadline applying to this law expired on April 10, 2021 without having been used.[3]

2 This law comes into force on January 1, 2023.[4]

| May 19, 2021 | On behalf of the Swiss Federal Council: The President of the Confederation, Guy Parmelin The Chancellor of the Confederation, Walter Thurnherr |

Annex

(ch. II)

Modification of other acts

The acts mentioned below are amended as follows:

1. Federal law of June 18, 2004 on partnership[5]

Art. 25, par. 2

Repealed

Art. 31, par. 2

2 Unless otherwise agreed, partners lose all benefits resulting from provisions due to death:

1. at the time of dissolution of the partnership;

2. at the time of death if dissolution proceedings resulting in the loss of the surviving partner's reserve are pending.

2. Law of June 25, 1982 on professional old-age, survivors and disability insurance[6]

Art. 82 Equivalent treatment of other forms of pension provision

1 Employees and self-employed people can also deduct contributions allocated exclusively and irrevocably to recognized forms of pension assimilated to professional pension. Are considered as such:

has. individual insurance linked to an insurance establishment;

b. individual pension provision linked to a banking foundation.

2 The Federal Council determines, with the collaboration of the cantons, to what extent the deductions referred to in para. 1 are admitted.

3 It sets the terms of recognized forms of insurance, in particular the circle and order of beneficiaries. It determines to what extent the pension holder can modify the order of beneficiaries and specify their rights; the arrangements made by the pension holder must be in written form.

4 Beneficiaries of a recognized form of pension provision have a specific right to the benefit that this form of pension provision grants them. The insurance establishment or banking foundation pays the benefit to the beneficiaries.

[1] FF 2018 5865

[2] RS 210

[3] FF 2020 9617

[4] The decision to put into force was the subject of a simplified decision procedure

on May 17, 2021.

[5] RS 211.231

[6] RS 831.40